Do you let your key suppliers take annual price increases of 3%-5% with no underlying cost justification?

Of course you don’t.

Then why do you let Coke and Pepsi do it?

Imagine your banker sent you a letter announcing that they are increasing your mortgage payment this year. Would you just accept that?

Now imagine that the same banker contacted you year after year with the same message: with no underlying rationalization, you are told your payment will again increase by 3%-5%. Would you stand for that happen?

Unfortunately, that’s exactly what is happening with your beverage business.

Over the last few months, if you do business with one of the primary soft drink providers, you probably received a letter announcing a 2020 national account fountain syrup price increase somewhere in the neighborhood of 5%.

While this is the largest price increase seen in more than a decade (in 2009 the price increases were greater than 7%), the industry has seen a price increase every single year since 1998.

When choosing a beverage partner, you work hard to structure a relationship that delivers a “win” for all the stakeholders: your consumers, your beverage supplier, your investors, and your strategic business partners. Such a partnership may include:

- A lump sum signing bonus

- Volume-based rebates

- Community sponsorship dollars

- Committed advertising dollars

- Equipment allotments

- Crew incentive programs

- And more

But over the life of your agreement, it’s possible that the price of the product charged on invoice escalates to the extent that it eventually wipes out any cost savings you may have once negotiated.

Are your franchisees, cafeteria operators or strategic business partners happy with the arrangement?

Rate of Increase = More than Double the Rate of Inflation

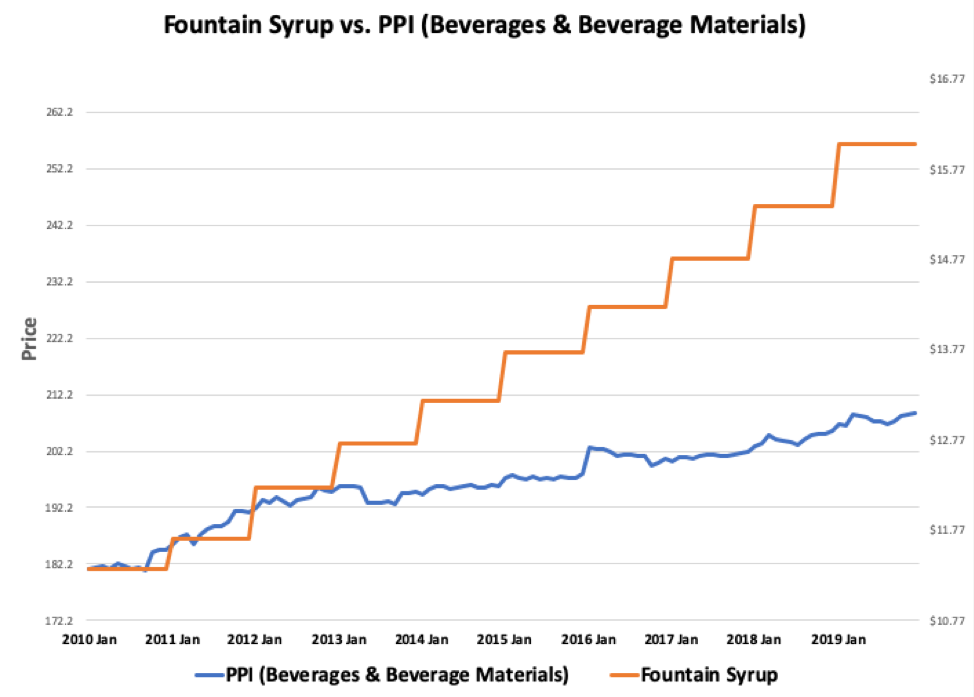

The problem isn’t just that that soda fountain prices have increased—it’s the rate at which they have increased. Fountain syrup cost is outpacing inflation by a drastically wide margin.

If you had $11.00 in 2010 (roughly the then price of a gallon national account syrup price), it would be worth approximately $13.00 today. But a gallon of soda syrup is now approaching $17.00.

Cumulatively, the price of soda fountain syrup has increased by nearly 50% over the last decade. Over the same time, the Consumer Price Index (“CPI”) has increased by less than 19%. The price of soda has outpaced the rate of inflation by more than double.

In fact, even if you isolate the analysis to only account for inflation within the beverage industry as a whole, the story remains the same. According to the Bureau of Labor and Statistics data, the rate of increase in cost of fountain syrup is more than double the rate of increase for the remainder of industry.

Data Source: BLS, http://beta.bls.gov/dataViewer/view/timeseries/WPU026

What Is Driving the Price Increases? (Hint: It’s Not the Component Costs)

What could drive the price of fountain syrup to increase at a rate so much higher than the rest of the economy? How could the increase in the cost of fountain syrup outpace the rest of the beverage industry by factor of greater than two?

Perhaps there’s some ingredient that has caused the increase?

Fountain syrup and its packaging are made of water, sweetener (corn syrup, sugar), flavorings, cardboard, and molded plastic.

The most expensive element of the ingredient mix is, presumably, the sweetener. What’s particularly curious, however, is that the price of both corn and sugar are both lower than the price they were a decade ago.

Price of Corn:

Source: http://www.macrotrends.net/2532/corn-prices-historical-chart-data

Price of Sugar:

Source: http://www.macrotrends.net/2537/sugar-prices-historical-chart-data

Over the same period that fountain prices have skyrocketed by nearly 50%, sweetener prices have plummeted.

While water prices have increased over the decade, according to the EPA, the cost of 1,000 gallons of water is roughly only $2.00, which means water only accounts for $0.002 of the nearly $17.00 price of fountain syrup. Cardboard prices have increased over the last decade, but plastics have on average remained relatively flat.

The simple answer is that there’s no single ingredient that can account for the astonishing increase in the price of fountain soda.

Where else could we turn to explain the dramatic rise? Could distribution costs be driving up the price?

With oil prices nearly 40% cheaper today than they were a year ago, it is again unlikely that delivery is the answer to our search.

Crude Oil:

Source: http://www.macrotrends.net/1369/crude-oil-price-history-chart

The steady increase of syrup pricing does not appear to be tied to any underlying commodity cost variation.

Both Coca-Cola and PepsiCo have made headlines over recent years with their continued efforts to drive down costs from their operating model. But what impact do these initiatives have? The fruits of these cost-cutting measures have not been passed on to their fountain customers — at least when it comes to price.

More Expensive for a Less Consumed Product

The increase of fountain prices is especially peculiar when you consider the overall landscape of the soft drink industry.

One justification for the price increase that customers repeatedly hear from beverage companies is that the cost of marketing the beverage brands increases every year. They rationalize the price increase by touting the benefit that their commercial customers receive from that marketing, which influence end consumers to buy more products at operator’s outlets. This, according the beverage companies, means their customers make more money by selling more drinks at higher prices.

Is that true?

It likely was once true that consumers recognize the brands and are comforted by the knowledge enough to want to buy the soft drinks at retail. But in recent years, that justification is becoming harder to swallow. According to article after article, soft drink consumption continues to decline at a dizzying pace. People are buying less soda when they dine out, not more. If the price increases are meant to fund marketing efforts and increase attachments, the endeavor has failed.

The laws of supply and demand tell us that as demand decreases, price should follow. In this case, however, the beverage companies are attempting to fight the conventions of economics 101.

The Real Reason for Fountain Price Increases

If the price of syrup is no longer tied to commodities or distribution costs, then what could cause the price to rise at such a significantly higher rate than the rest of the economy?

It’s not hard to find the answer. Coca-Cola and PepsiCo have both publicly represented to investors that a key component of their financial strategy is to increase the price per unit of their beverage products.

For example, in Coca-Cola’s third-quarter earnings call, Coca Cola’s CFO John Murphy disclosed that of the company’s 5% organic revenue growth, only 1% came from increased global volume. The remaining 4% was attributed to “strong price/mix due to our revenue growth management initiatives in the marketplace…”

On Pepsi’s earning call, CEO Ramon Laguarta similarly outlined that Pepsi’s revenue growth was “driven by solid net price realization, the result of effective revenue management execution.”

In other words, the strategy of both beverage companies is to grow top-line revenue by increasing unit pricing.

You can easily see this strategy at play in the grocery store, where you can now buy a 10-pack of 7.5oz cans of soda for only a slightly lower price than a 12-pack of 12oz cans. When you calculate the price on a per ounce basis, you quickly find that you are paying much more for less product when you grab the 7.5oz pack.

The strategy is working. The industry has largely accepted the price increases, which has led to impressive performance on Wall Street:

Coke Stock Price:

Source: http://www.macrotrends.net/stocks/charts/KO/coca-cola/stock-price-history

Pepsi Stock Price:

Source: http://www.macrotrends.net/stocks/charts/PEP/pepsico/stock-price-history

The price of fountain syrup over the previous ten years follows the beverage company’s stock performance over the same time period much more closely than it follows any underlying commodity that we could identify.

Fountain price increases are not about cost inputs, but rather about stock price outputs.

A Tipping Point for Beverage Prices

These price increases are not just numbers on a page – they have a real impact to both businesses and to consumers.

We have the pleasure of working with some of the best and brightest in our industry. One president of a well-known foodservice brand recently described the fountain pricing dilemma eloquently. He told us that he now needs to charge at least $2.00 for a soft drink and that a family of four now pays over $8.00 for the drinks alone. The price of those four drinks is higher than most of his concept’s entrees!

What’s the result for most restaurant operators? Revenues decrease due to price sensitivity and health concerns while costs increase due to higher national account pricing. The beverage company’s commercial customers are getting squeezed.

Soft drinks became mainstream, in part, because of their affordability. The recent rate of price increases, however, threatens what was once a core pillar of the industry.

What Can You Do?

As we’ve seen, these price increases severely impact a company’s cost of beverage goods. Over a typical five-year agreement, a conservative 3.5% annual increase will ultimately increase your price by nearly 19%. In other words, that $17 gallon will cost over $20 at the end of your agreement. The chances are likely that your marketing and business development funds will not keep up with those price hikes.

So what can you do about it?

Negotiating the right contractual terms up front is the key to keeping costs low. Having a strategy for cost containment in your next contract is imperative.

If you don’t do it right, your profits will naturally erode.

We’re here to help. Contact us today for a free, no-strings-attached analysis of your current beverage program and how you may be able to mitigate these price increases in the future.

Related Articles:

Three Ways that Unmonitored Beverage Deals Cost You Money

Five Things Your Soft Drink Representative Doesn’t Want You to Know

Photo by Jungwoo Hong on Unsplash